The pros and cons of using a credit card are many. There are a lot of people who use credit cards every day for small things such as buying groceries from a store to large things such as buying a car. There are certain key points to be remembered while using a credit card so that your finances do not plummet disastrously. Let us witness the areas where you can benefit from the sagacious use of credit cards:

- You should always be aware of your credit status and make sure that the correct data of every spending is registered in your credit report.

- You must show the attitude of spending judiciously by spending in small segments. To purchase daily goods such as groceries, you could use a credit card that has a pruned limit.

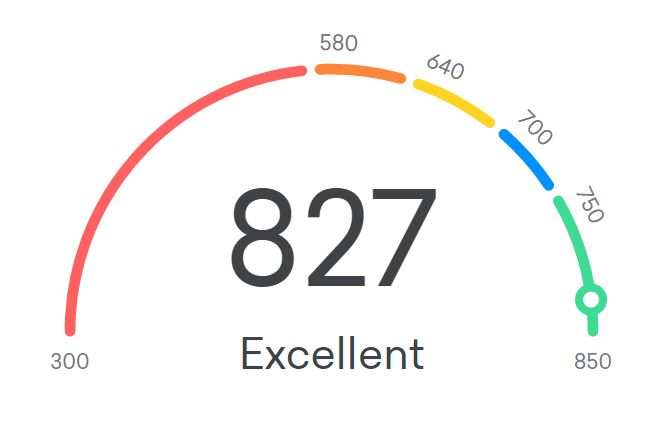

- Credit has a very strange formula that is applied to it. The more a person needs a credit, the lesser he can have it and vice-versa. Hence to prove to creditors that you are worthy of getting credits, you should make it a point not to spend more than half of your prescribed credit limit.

- The former credit lines should not be closed, rather kept available for future use even if they have zilch balance.

What Mistakes Should You Avoid?

The following are the list of mistakes that one should avoid maintaining a good credit profile:

- If you do not maintain a good credit profile, then you can be barred from giving mortgages. An option to mortgage is renting, but it requires heavy amounts of deposits and unavoidable terms and conditions.

- In case of bad credit or lack of money, there are other facilities such as overdraft which are opted by people. The combined effect of this can lead to all your finances draining rapidly.

- Credit cards with nominal interest rates are available to people with good credit profiles, while people who are not having such profiles get credit cards with more interest rates that further take a toll on finances of the person.

- While taking loans for buying new properties, cars, and houses, one is required to pay off those loans based on a decided rate of interest. If your credit score is bad, you may not be offered a compensated interest rate as compared to a person who has an outstanding credit profile.

- The chances of getting a good job are more if one has a good credit score as it reflects the reliability of the person.

Hence it is important to keep a good credit profile along with sagacious spending. You can click this site for further details regarding this.

You may also like

-

Swift Solutions: The Essentials of Quick Loans for Fast-Tracking Financial Goals

-

Mastering Binary Options with Quotex: Strategies for Success

-

Buying Cryptocurrency: A New Investors’ Guide to Crypto Success

-

Small Steps, Big Wins: The Optimistic Impact of No Credit Check Loans

-

Generating Passive Income Through Investment